Property Taxes Arizona Vs New Mexico . this year, the states with the best scores on the property tax component are new mexico, indiana, utah, idaho, arizona, and north dakota. with an effective property tax of only 0.28%, the state boasts the lowest property taxes by state. State and local governments in new mexico rely. the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. States, laws require the majority of property owners to pay real estate taxes, and property taxes vary by state. Alabama and louisiana are the two. the median property tax in arizona is $1,356.00 per year for a home worth the median value of $187,700.00. property tax as a percent of state and local general revenue, 2019. the mix of taxes the states use to finance their activities can vary markedly from state to state. If you are considering a. in all 50 u.s.

from taxunfiltered.com

with an effective property tax of only 0.28%, the state boasts the lowest property taxes by state. If you are considering a. States, laws require the majority of property owners to pay real estate taxes, and property taxes vary by state. property tax as a percent of state and local general revenue, 2019. the median property tax in arizona is $1,356.00 per year for a home worth the median value of $187,700.00. the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. Alabama and louisiana are the two. this year, the states with the best scores on the property tax component are new mexico, indiana, utah, idaho, arizona, and north dakota. the mix of taxes the states use to finance their activities can vary markedly from state to state. in all 50 u.s.

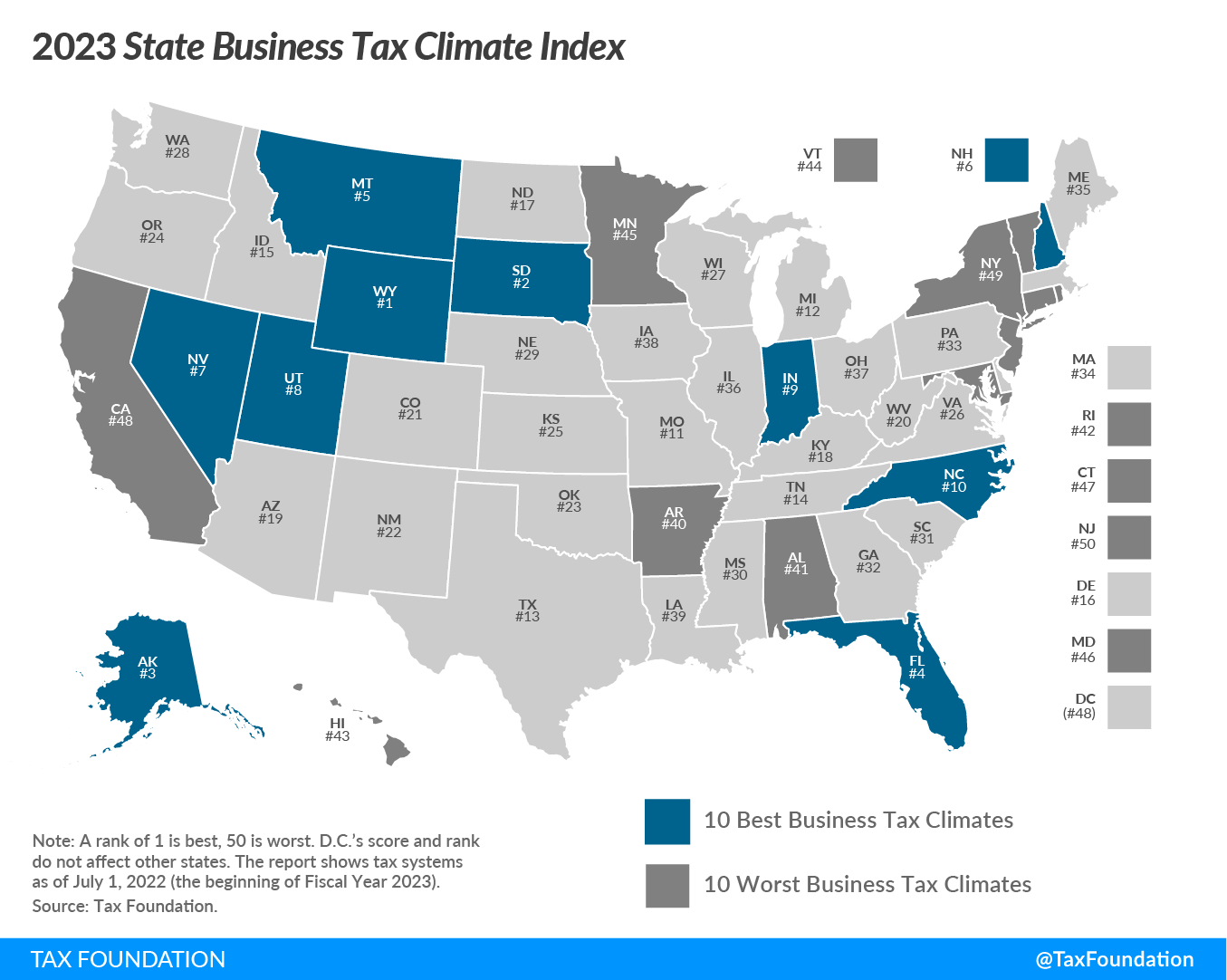

2023 State Business Tax Climate Index Tax Unfiltered

Property Taxes Arizona Vs New Mexico property tax as a percent of state and local general revenue, 2019. the median property tax in arizona is $1,356.00 per year for a home worth the median value of $187,700.00. this year, the states with the best scores on the property tax component are new mexico, indiana, utah, idaho, arizona, and north dakota. in all 50 u.s. Alabama and louisiana are the two. the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. property tax as a percent of state and local general revenue, 2019. States, laws require the majority of property owners to pay real estate taxes, and property taxes vary by state. If you are considering a. the mix of taxes the states use to finance their activities can vary markedly from state to state. State and local governments in new mexico rely. with an effective property tax of only 0.28%, the state boasts the lowest property taxes by state.

From taxfoundation.org

2019 State Individual Tax Rates and Brackets Tax Foundation Property Taxes Arizona Vs New Mexico the median property tax in arizona is $1,356.00 per year for a home worth the median value of $187,700.00. States, laws require the majority of property owners to pay real estate taxes, and property taxes vary by state. property tax as a percent of state and local general revenue, 2019. Alabama and louisiana are the two. If you. Property Taxes Arizona Vs New Mexico.

From www.cashreview.com

State Corporate Tax Rates and Brackets for 2023 CashReview Property Taxes Arizona Vs New Mexico Alabama and louisiana are the two. the median property tax in arizona is $1,356.00 per year for a home worth the median value of $187,700.00. the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. this year, the states with the best scores on the property tax. Property Taxes Arizona Vs New Mexico.

From www.yoursurvivalguy.com

The Highest Property Taxes in America Your Survival Guy Property Taxes Arizona Vs New Mexico States, laws require the majority of property owners to pay real estate taxes, and property taxes vary by state. in all 50 u.s. the mix of taxes the states use to finance their activities can vary markedly from state to state. Alabama and louisiana are the two. property tax as a percent of state and local general. Property Taxes Arizona Vs New Mexico.

From www.nationalmortgagenews.com

20 states with the lowest property taxes National Mortgage News Property Taxes Arizona Vs New Mexico property tax as a percent of state and local general revenue, 2019. States, laws require the majority of property owners to pay real estate taxes, and property taxes vary by state. in all 50 u.s. with an effective property tax of only 0.28%, the state boasts the lowest property taxes by state. the mix of taxes. Property Taxes Arizona Vs New Mexico.

From flipboard.com

SoCal Real Estate AgentYogiPlants Flipboard Property Taxes Arizona Vs New Mexico State and local governments in new mexico rely. the median property tax in arizona is $1,356.00 per year for a home worth the median value of $187,700.00. the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. with an effective property tax of only 0.28%, the state. Property Taxes Arizona Vs New Mexico.

From www.pinterest.com

United States Federal Tax Dollars Welfare state, Financial literacy Property Taxes Arizona Vs New Mexico the median property tax in arizona is $1,356.00 per year for a home worth the median value of $187,700.00. in all 50 u.s. with an effective property tax of only 0.28%, the state boasts the lowest property taxes by state. Alabama and louisiana are the two. this year, the states with the best scores on the. Property Taxes Arizona Vs New Mexico.

From www.armstrongeconomics.com

US Property Tax Comparison by State Armstrong Economics Property Taxes Arizona Vs New Mexico Alabama and louisiana are the two. the mix of taxes the states use to finance their activities can vary markedly from state to state. in all 50 u.s. If you are considering a. States, laws require the majority of property owners to pay real estate taxes, and property taxes vary by state. State and local governments in new. Property Taxes Arizona Vs New Mexico.

From www.armstrongeconomics.com

US Property Tax Comparison by State Armstrong Economics Property Taxes Arizona Vs New Mexico If you are considering a. in all 50 u.s. the median property tax in arizona is $1,356.00 per year for a home worth the median value of $187,700.00. the mix of taxes the states use to finance their activities can vary markedly from state to state. State and local governments in new mexico rely. property tax. Property Taxes Arizona Vs New Mexico.

From www.zrivo.com

Arizona Property Tax 2023 2024 Property Taxes Arizona Vs New Mexico the median property tax in arizona is $1,356.00 per year for a home worth the median value of $187,700.00. State and local governments in new mexico rely. the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. property tax as a percent of state and local general. Property Taxes Arizona Vs New Mexico.

From hubpages.com

Which States Have the Lowest Property Taxes? HubPages Property Taxes Arizona Vs New Mexico the median property tax in arizona is $1,356.00 per year for a home worth the median value of $187,700.00. this year, the states with the best scores on the property tax component are new mexico, indiana, utah, idaho, arizona, and north dakota. the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in. Property Taxes Arizona Vs New Mexico.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Property Taxes Arizona Vs New Mexico in all 50 u.s. the median property tax in arizona is $1,356.00 per year for a home worth the median value of $187,700.00. the mix of taxes the states use to finance their activities can vary markedly from state to state. this year, the states with the best scores on the property tax component are new. Property Taxes Arizona Vs New Mexico.

From www.youtube.com

Arizona Property Taxes Arizona Property Tax Popular Video 💫 Free Property Taxes Arizona Vs New Mexico with an effective property tax of only 0.28%, the state boasts the lowest property taxes by state. the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. Alabama and louisiana are the two. State and local governments in new mexico rely. If you are considering a. States, laws. Property Taxes Arizona Vs New Mexico.

From arizonarealestatenotebook.com

Arizona property taxes are much lower than in California, Florida or Texas Property Taxes Arizona Vs New Mexico the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. State and local governments in new mexico rely. this year, the states with the best scores on the property tax component are new mexico, indiana, utah, idaho, arizona, and north dakota. Alabama and louisiana are the two. . Property Taxes Arizona Vs New Mexico.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Property Taxes Arizona Vs New Mexico the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. States, laws require the majority of property owners to pay real estate taxes, and property taxes vary by state. Alabama and louisiana are the two. property tax as a percent of state and local general revenue, 2019. . Property Taxes Arizona Vs New Mexico.

From taxfoundation.org

How High Are Property Tax Collections in Your State? Tax Foundation Property Taxes Arizona Vs New Mexico in all 50 u.s. property tax as a percent of state and local general revenue, 2019. the mix of taxes the states use to finance their activities can vary markedly from state to state. State and local governments in new mexico rely. this year, the states with the best scores on the property tax component are. Property Taxes Arizona Vs New Mexico.

From www.youtube.com

Why So Many Americans Move To Arizona And Not New Mexico YouTube Property Taxes Arizona Vs New Mexico property tax as a percent of state and local general revenue, 2019. the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. States, laws require the majority of property owners to pay real estate taxes, and property taxes vary by state. Alabama and louisiana are the two. . Property Taxes Arizona Vs New Mexico.

From www.financial-planning.com

20 states with the lowest realestate property taxes Financial Planning Property Taxes Arizona Vs New Mexico the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. States, laws require the majority of property owners to pay real estate taxes, and property taxes vary by state. with an effective property tax of only 0.28%, the state boasts the lowest property taxes by state. State and. Property Taxes Arizona Vs New Mexico.

From azgroundgame.org

Arizona’s Mismatched Budget The Arizona Ground Game Property Taxes Arizona Vs New Mexico If you are considering a. with an effective property tax of only 0.28%, the state boasts the lowest property taxes by state. this year, the states with the best scores on the property tax component are new mexico, indiana, utah, idaho, arizona, and north dakota. the median property tax in arizona is $1,356.00 per year for a. Property Taxes Arizona Vs New Mexico.